Mortgage Blogs

Stay up to date with the recent industry news and mortgage trends.

How Bond Yields and the Bank of Canada Shape Mortgage Rates

How Bond Yields and the Bank of Canada Shape Mortgage Rates: What to Expect Through 2026

Understanding what drives mortgage rates can give you an important edge when making financial decisions. Rates don’t move randomly; they follow the signals of government bond markets and the Bank of Canada’s policy decisions. By looking at both, we can get a clearer view of where rates are today and where they may head over the remainder of 2026.

The Building Blocks: Bond Yields and BoC Policy

Government Bond Yields

The 5-year Government of Canada bond yield is the key benchmark for fixed-rate mortgages. Lenders use this yield as a starting point, then add a spread to cover costs, risks, and profits. When 5-year yields rise, fixed mortgage rates almost always climb. When yields fall, fixed rates tend to ease — although lenders sometimes widen spreads in volatile markets.

Bank of Canada Overnight Rate

The Bank of Canada sets the overnight policy rate, which directly drives prime rates at banks. Variable-rate mortgages and HELOCs are priced off prime, meaning these products react immediately when the BoC moves. Unlike fixed rates, which shadow bond yields, variable rates are more directly tied to the Bank’s monetary policy.

The Spread

Fixed mortgage rates are always above bond yields. The difference — the spread — reflects default risk, administration, early prepayment options, and lender profit. In uncertain times, spreads can widen, which keeps mortgage rates higher even if bond yields drift down.

Where We Stand Now

The Bank of Canada’s overnight rate sits at 2.75% following several cuts since mid-2024.

The 5-year Government of Canada bond yield is currently hovering around 2.8%–2.9%.

For borrowers, this means variable products have already benefited more from the recent BoC cuts, while fixed rates are adjusting based on bond market expectations. Fixed mortgage offers today are still influenced by lender spreads, which remain elevated compared to pre-2020 levels.

What to Expect at Next Week’s Bank of Canada Decision

Markets are almost unanimous that the Bank of Canada will hold the overnight rate at 2.75% in its upcoming announcement. Inflation has eased but is not yet fully under control, and the economy, while slowing, has pockets of resilience.

Our probability outlook:

~85% chance of no change

~15% chance of a 25-basis-point cut if economic data shows a sharper slowdown than anticipated

In other words, borrowers should not expect immediate relief at this meeting, but the Bank is keeping the door open to further cuts later in 2026.

Key Risks to Watch

Stubborn inflation that forces the BoC to pause cuts or even hike again

Global interest rate pressure, particularly from the U.S. Federal Reserve

Government debt issuance adding supply to the bond market, pushing yields higher

Mortgage renewals: a large wave of renewals is coming, and how households absorb higher payments will affect consumer spending and the economy

What This Means for You

Fixed-rate borrowers may want to consider locking in if stability is more important than chasing potential rate declines.

Variable-rate borrowers could see more benefit if cuts materialize in 2026, but they must be comfortable with uncertainty.

Renewals: Start early and shop widely. Non-bank (monoline) lenders sometimes offer more competitive fixed spreads, though features and flexibility can differ.

Bottom Line

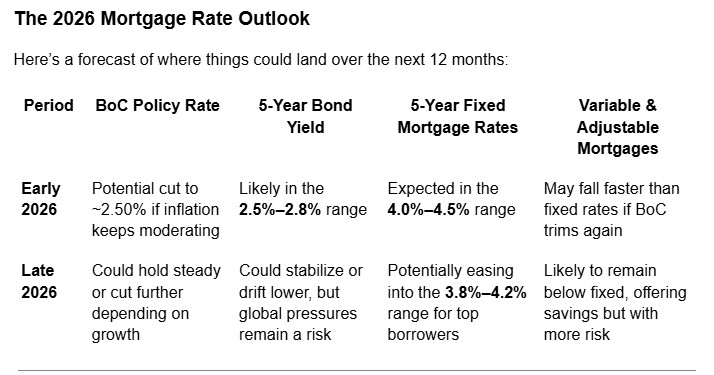

Looking ahead, by the end of 2026 we expect:

5-year fixed mortgage rates in the 3.8%–4.2% range under favorable conditions, though spreads may keep most offers closer to 4.0%–4.5%.

Variable-rate mortgages will likely be lower than fixed in most scenarios, especially if the Bank of Canada delivers further cuts.

Next week’s rate decision will likely be a “hold,” but the direction is clear: the Bank of Canada has shifted from fighting inflation with hikes to cautiously cutting, with more room to move if the economy slows further.

Let’s talk about your options

📞 (289) 686-9988

Trusted Guidance, Proven Success

Jesse Stone | Mortgage Agent Level 2

(289) 686-9988

Assistance Hours

Sun – Sat 9:00am – 8:00pm

Get In Touch With

(289) 686-9988

Assistance Hours

Mon – Fri 9:00am – 8:00pm

Saturday/Sunday – CLOSED

Contact Us

© 2025 Jesse Stone - BRX Mortgage - All Rights Reserved.

Jesse Stone, Mortgage Agent Level 2 M22002295

BRX Mortgage Inc. 13463